What is asset tokenization? A Simple Guide for Businesses and Investors

In recent years, the convergence of blockchain technology with real-world assets has given rise to a revolutionary concept—asset tokenization. As we move towards a more digitized economy, the ability to represent physical or intangible assets as digital tokens on a blockchain opens up a wealth of opportunities for businesses and investors alike.

But what exactly is asset tokenization? How does it work? And why should businesses and investors care?

This guide answers these questions in simple terms and explores how asset tokenization shapes the future of ownership, investment, and asset management.

What is asset tokenization?

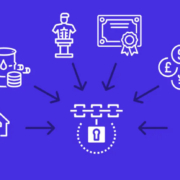

Asset tokenization is converting the ownership rights of a real-world asset, such as real estate, stocks, commodities, or art, into a digital token on a blockchain. These tokens represent a specific value or share in the asset and can be bought, sold, or traded much like cryptocurrency.

For example, imagine you own a $1 million commercial property. Through tokenization, you could divide the property into 1,000 tokens, each representing 0.1% ownership. Investors worldwide could purchase these tokens, thereby gaining fractional ownership in the property.

How Does Asset Tokenization Work?

The asset tokenization process involves several steps:

- Asset Identification and Valuation: The asset (e.g., real estate, artwork, intellectual property) is selected and valued by professionals.

- Legal Structuring: Legal frameworks are established to ensure that actual ownership rights back the tokens. This often involves forming a legal entity that holds the asset and issues the tokens.

- Token Creation: Using a blockchain, digital tokens represent the asset. These tokens are governed by smart contracts, which automate rules like dividends, voting rights, or transfer restrictions.

- Listing on a Tokenization Platform: The tokens are listed on an asset tokenization platform, allowing them to be traded, sold, or distributed.

- Ongoing Management and Compliance: Issuers maintain legal compliance, ensure reporting transparency, and distribute returns (if applicable) to token holders.

Types of Assets That Can Be Tokenized

Virtually any asset with economic value can be tokenized. The most common categories include

1. Real Estate

One of the most widely adopted applications of tokenization. Residential and commercial properties can be fractionalized, increasing liquidity and access for investors. Many businesses seek a real estate token development company to create custom solutions for digitizing property assets.

2. Commodities

Gold, oil, and other commodities can be tokenized for seamless, secure trading.

3. Equities and Bonds

Security tokens can represent shares in a company or fixed-income assets like bonds.

4. Art and Collectibles

Fine art, rare wines, and collectibles can be digitized and sold in parts, making investing easier for enthusiasts.

5. Intellectual Property

Royalties from music, films, or patents can be tokenized and sold to investors.

Benefits of Asset Tokenization

The growing interest in asset tokenization stems from its numerous benefits to asset owners and investors.

1. Increased Liquidity

Traditionally illiquid assets like real estate or art become easily tradable when tokenized. Investors can buy and sell tokens on secondary markets, unlocking capital that would otherwise remain tied up.

2. Fractional Ownership

Tokenization enables fractional investment, allowing smaller investors to access high-value assets. This democratizes investment and expands the investor pool.

3. Transparency and Security

Blockchain records all transactions in a transparent, immutable ledger. This enhances trust among participants and reduces fraud.

4. Global Reach

Investors worldwide can participate in tokenized assets, opening new funding avenues and investment opportunities.

5. Reduced Costs

By eliminating intermediaries such as brokers and lawyers through smart contracts, tokenization reduces transaction costs and settlement times.

Challenges and Risks

Despite its promise, asset tokenization is not without its challenges.

1. Regulatory Uncertainty

Regulations around security tokens vary by country and are still evolving. This creates legal complexity and risk for token issuers and investors.

2. Technology Adoption

Blockchain adoption is still maturing. Businesses must choose robust, scalable asset tokenization platform development platforms to ensure long-term success.

3. Market Liquidity

While tokenization increases potential liquidity, actual market liquidity depends on the availability of active buyers and sellers.

4. Security Risks

Smart contract bugs and hacking threats can compromise the integrity of tokenized assets. Rigorous audits and cybersecurity measures are essential.

Real-World Use Cases

● Real Estate Crowdfunding

Platforms like RealT and SolidBlock have enabled investors to buy shares in real estate properties worldwide through tokenization.

● Luxury Art Investments

Maecenas has tokenized fine art, allowing investors to buy fractions of famous paintings and diversify their portfolios.

● Tokenized Gold and Commodities

Companies like Paxos and Tether offer tokenized versions of gold that are fully backed by physical reserves.

● Revenue-Sharing Models

Musicians and filmmakers have begun using tokenization to offer fans fractional rights in royalties and revenue streams.

How Businesses Can Benefit from Asset Tokenization

If you’re a business owner or asset manager, tokenization can transform your funding and liquidity strategy.

- Raise Capital More Efficiently: Instead of going through complex IPOs or traditional fundraising methods, businesses can issue tokens to raise capital directly from global investors.

- Improve Asset Management: Tokenized assets allow real-time tracking and performance analysis via blockchain, improving decision-making.

- Enhance Customer Engagement: Some businesses offer tokens as part of customer loyalty or revenue-sharing programs, enhancing brand loyalty and investment interest.

Working with an experienced asset tokenization platform development partner ensures seamless integration of tokenization into your existing business model.

What to Look for in an Asset Tokenization Platform

When choosing or building a platform for tokenization, consider these key factors:

- Security and Compliance: Ensure the platform meets local and international regulatory requirements.

- Smart Contract Functionality: Automating transactions, dividends, and rights allocation via smart contracts is essential.

- Multi-Asset Support: A flexible platform should allow for tokenizing different asset types.

- Interoperability: The platform should integrate with existing blockchain networks and external wallets for easy access.

- User-Friendly Interface: Investors should find it easy to sign up, verify identity (KYC), invest, and track their tokens.

The Role of a Real Estate Token Development Company

Tokenization can provide a game-changing edge for real estate businesses. Partnering with a real estate token development company ensures the digital transformation of your assets is done securely and strategically.

These companies specialize in:

- Custom token creation tailored to property type and investment model

- Legal structuring and compliance integration

- Smart contract development for automatic rent distribution or voting rights

- Platform development and ongoing maintenance

- Investor dashboard and management systems

With the real estate market becoming increasingly global, digital, and investor-focused, tokenization is no longer a luxury—it’s a necessity.

The Future of Asset Tokenization

As blockchain adoption grows, asset tokenization is expected to become mainstream. Institutional interest in security tokens is rising, and regulators are slowly catching up to support compliant token markets.

In the next 5–10 years, we may see:

- Tokenized portfolios becoming standard in wealth management

- Entire real estate markets shifting toward digital ownership models

- Governments are using blockchain to issue land titles or public bonds.

- Major stock exchanges are integrating tokenized assets alongside traditional listings.

For businesses and investors ready to embrace innovation, now is the time to explore asset tokenization.

Final Thoughts

Asset tokenization offers a compelling bridge between traditional finance and digital innovation. Transforming how assets are bought, sold, and managed empowers businesses and investors with greater efficiency, accessibility, and transparency.

Expert guidance is crucial whether you want to tokenize a property portfolio or build a comprehensive platform for trading digital assets. From legal structuring to blockchain implementation, the right development partner makes all the difference.

Leave a Reply

Want to join the discussion?Feel free to contribute!