What Happens When Luxury Cars Meet Blockchain Tokenization?

Luxury cars have always been a symbol of elegance, prestige, and exclusivity. From roaring Lamborghinis to sleek Rolls-Royces, owning one isn’t just about transportation it’s about status. But in the age of blockchain, these iconic machines are stepping into a whole new lane: tokenization. This is where the high-octane world of supercars collides with cutting-edge digital finance. And who’s driving this shift? An asset tokenization development company can help bridge the gap between physical ownership and digital investment, enabling fractional ownership, liquidity, and global accessibility for high-value assets like luxury cars.

Imagine owning 5% of a Bugatti Chiron without spending millions upfront and selling your stake in seconds to a buyer across the world. That’s the power of blockchain tokenization in the luxury car industry.

Luxury Cars and the Tokenization Revolution

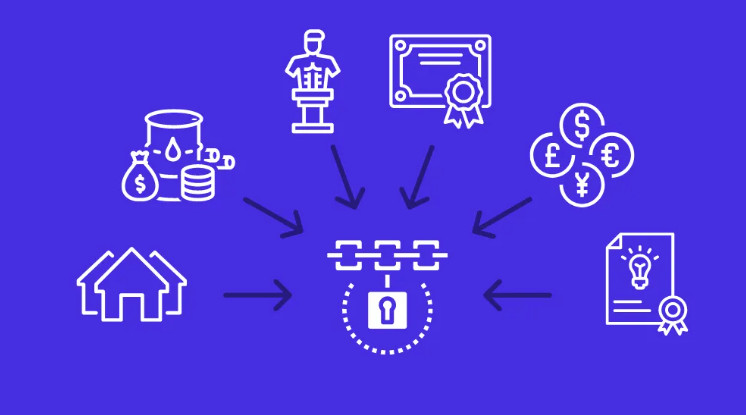

Tokenization is the process of converting a tangible asset like a luxury car into digital tokens on a blockchain. These tokens represent ownership shares, and each one is immutable, transparent, and easily tradable. The concept is already transforming real estate, fine art, and commodities, but now luxury automobiles are revving their engines toward the same track.

The appeal for luxury car enthusiasts and investors is clear:

- Fractional ownership opens the door for more people to invest.

- Liquidity enables quick buying and selling without the hassles associated with traditional asset transfers.

- Global markets make luxury car investments borderless.

Why Tokenize Luxury Cars?

Luxury cars are not just depreciating assets; in some cases, they are appreciating collectibles. Limited-edition Ferraris, vintage Aston Martins, and rare McLarens often gain value over time. Tokenization turns these high-value vehicles into investment opportunities accessible to more than just ultra-wealthy buyers.

Key benefits include:

- Lower Entry Barriers – No need for millions; investors can participate with smaller amounts.

- Secondary Markets – Owners can sell their tokens at any time without selling the entire car.

- Secure Ownership Records – Blockchain ensures tamper-proof proof of ownership.

- Global Accessibility – A collector in Tokyo can invest in a Lamborghini in Los Angeles within minutes.

How Blockchain Tokenization Works for Luxury Cars

The process involves several steps:

- Asset Valuation – Experts assess the car’s market value.

- Token Creation – The asset is digitally divided into tokens.

- Smart Contracts – Rules for ownership, usage, and resale are encoded on the blockchain.

- Investor Access – Tokens are listed on a digital marketplace for investors.

The technology behind this transformation is sophisticated, requiring secure platforms, regulatory compliance, and precise valuation. These complexities contribute to the asset tokenization platform development cost, which varies depending on functionality, blockchain type, and compliance measures.

The Economics of Tokenized Supercars

Tokenization changes the economic model of luxury car ownership:

- Revenue Generation – The car can be rented for events, with profits distributed proportionally to token holders.

- Resale Gains – If the car’s value increases, token holders benefit from capital appreciation.

- Maintenance & Insurance – Costs are split proportionally, making ownership more sustainable.

This model appeals to both car enthusiasts and traditional investors seeking diversification.

The Role of Blockchain in Building Trust

High-value investments require trust and blockchain provides it. Every transaction, from the car’s purchase to fractional transfers, is recorded on a public ledger. No central authority can manipulate these records, reducing fraud risk.

For investors, the best tokenization platform for financial services must ensure:

- Security – Protection against cyber threats and hacks.

- Transparency – Clear, immutable transaction histories.

- Liquidity Options – Easy buying and selling through digital exchanges.

- Regulatory Compliance – Meeting local and international asset ownership laws.

Challenges in Luxury Car Tokenization

While the concept is exciting, it’s not without roadblocks:

- Regulatory Uncertainty – Securities laws differ across jurisdictions.

- Asset Custody – The physical car must be stored securely.

- Market Education – Many investors still don’t understand tokenization.

- Liquidity Limits – The market for luxury car tokens is still young.

However, early adopters are paving the way, and as awareness grows, these challenges are expected to diminish.

Case Studies: Luxury Cars on the Blockchain

Several companies have already tested the waters:

- CurioInvest – Tokenized rare collectible cars like the Ferrari F12tdf.

- BitCar – Offers fractional ownership in exotic vehicles.

- NFT Car Auctions – Rare vehicles paired with NFT ownership certificates for collectors.

These pioneers demonstrate that the market potential is enormous, particularly as technology continues to mature.

Luxury Cars vs. Other Tokenized Assets

Luxury cars differ from other tokenized assets in several ways:

- Depreciation Risk – Unlike real estate, many cars lose value over time unless they are rare collectibles.

- Maintenance Needs – Cars require ongoing upkeep to retain value.

- Emotional Connection – Car ownership is often driven by passion as much as investment returns.

This blend of passion and profit is what makes luxury car tokenization so unique.

Real Estate Tokenization Development and Cross-Industry Insights

Interestingly, luxury car tokenization borrows heavily from real estate tokenization development. Both involve high-value physical assets, fractional ownership, and complex legal frameworks. Lessons from the real estate sector such as clear governance rules, maintenance management, and secure custody are now shaping how luxury car tokenization platforms operate.

By applying these proven strategies, tokenization can scale beyond collectibles into mainstream asset investment.

Future Outlook: Where Are We Heading?

In the next decade, we may see:

- Global Tokenized Car Exchanges – Platforms dedicated to high-end automobile investments.

- Integration with the Metaverse – Virtual showrooms for tokenized cars.

- Automated Revenue Models – Token holders earning from real-world usage.

- Hybrid Investment Portfolios – Combining cars, art, and property in one blockchain wallet.

Conclusion

The fusion of luxury cars and blockchain tokenization is more than a tech experiment it’s a paradigm shift in asset ownership. By partnering with an asset tokenization development company, investors can turn high-value cars into liquid, tradeable digital assets accessible to a global audience. While challenges remain, the technology, investor interest, and luxury market appeal align perfectly to create a thriving ecosystem.

From Bugattis to Bentleys, the future of owning and investing in luxury cars is a click or a token away.

Leave a Reply

Want to join the discussion?Feel free to contribute!