The Rise of Tokenized Real Estate: A Game Changer for Property Markets

The world of real estate is undergoing a silent revolution one powered by blockchain, fractional ownership, and digital assets that move with the speed of the internet. For decades, property markets were known for slow transactions, high entry barriers, and limited liquidity. But today, a new wave of innovation is unlocking opportunities once reserved for institutional giants. This is the era of tokenized real estate, and at its core lies the technological foundation driven by asset tokenization platform development, enabling investors across the globe to participate in property ownership like never before.

A New Dawn in Property Investment

The concept of tokenized real estate is simple but transformative. It involves converting ownership of physical property into digital tokens stored on a blockchain. Each token represents a share of the asset, allowing investors to buy, sell, and trade fractional ownership without the complexities of traditional property transfers. This digital evolution is making real estate more inclusive, efficient, and borderless.

In traditional markets, property ownership demanded substantial capital, complex documentation, and lengthy settlement times. Tokenization breaks this cycle by enabling micro-investments that anyone can participate in, often with just a few clicks. The global push toward decentralized finance (DeFi) and blockchain-based ecosystems has amplified this transition, bringing fresh liquidity to an industry long criticized for its rigidity.

Technology, therefore, becomes the backbone of this transformation. Smart contracts automate transactions, ensure transparency, and reduce the role of intermediaries. Blockchain ledgers track ownership immutably, giving investors complete trust in the process. The result is a streamlined experience that appeals to modern tech-driven investors and property developers seeking global exposure.

How Tokenization Works Behind the Scenes

To understand why tokenized real estate is a breakthrough, it’s essential to examine the mechanics that make it possible. Real estate assets, whether commercial buildings, vacation homes, or rental units, are digitized and represented as tokens on a blockchain. These tokens can be divided into thousands of smaller parts, each representing a portion of ownership.

Investors purchasing these tokens gain proportional rights, such as profit-sharing, rental income, and appreciation. Unlike conventional transactions that require lawyers, brokers, and lengthy verification steps, tokenized transactions are handled by smart contracts that execute terms automatically once predetermined conditions are met.

The choice of blockchain is also crucial. Platforms like Ethereum, Polygon, Solana, Avalanche, and private enterprise blockchains each offer diverse capabilities for scalability, compliance, and transaction efficiency. Project teams typically evaluate regulatory requirements, asset types, and ecosystem goals before selecting the ideal protocol.

The impact is profound. Tokenized real estate creates new liquidity by allowing investors to trade property shares on digital marketplaces. This secondary trading capability democratizes access to real estate in a way traditional methods never could.

Why Tokenized Real Estate is Gaining Global Momentum

The rise of tokenized real estate is not accidental; it is a direct response to evolving investor demands and global market constraints. High-interest rates, inflation, and economic uncertainty have pushed investors to seek stable, income-generating assets. Real estate has always been a haven, but tokenization amplifies its accessibility and liquidity.

Moreover, global investors increasingly prefer automated, digital-first solutions that reduce bureaucracy. Tokenization aligns perfectly with this appetite for seamless and transparent investments. It eliminates geographical restrictions, opening the doors for Asian investors to invest in European properties or for U.S. investors to own fractional shares in luxury villas in Dubai.

Blockchain’s inherent transparency provides an added layer of trust. Every transaction is verifiable, secure, and tamper-proof, reducing fraud and enhancing confidence among participants. The inclusion of compliance mechanisms and regulatory frameworks further strengthens its appeal among institutional investors and real estate developers looking to expand their portfolios.

As the adoption of digital assets increases, tokenized real estate becomes a natural extension of the global financial evolution. And with the rise of digital-native generations, demand for fractional and borderless ownership continues to accelerate.

The Role of RWA in Expanding Investment Horizons

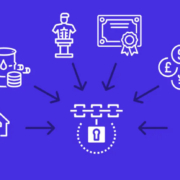

At the heart of this transformation lies a powerful concept: Real World Assets, commonly known as RWAs. These include physical assets such as property, gold, art, and commodities that are tokenized and represented on blockchain networks. The connection between tokenized real estate and the broader RWA ecosystem is not merely functional but strategic.

The integration of rwa tokenization development into real estate tokenization creates an interoperable investment landscape where physical assets can exist in digital formats, providing stability and lower volatility compared to typical crypto assets. Investors who once relied solely on digital tokens or cryptocurrencies can now diversify into tangible assets with long-term appreciation potential.

The blending of traditional finance and decentralized finance (DeFi) has created a hybrid model that enables tokenized real estate to be used as collateral, as yield-generating assets, or as part of liquidity pools. This evolution is attracting venture capital firms, hedge funds, and asset managers who see immense potential in merging property investments with modern blockchain frameworks.

Benefits That Are Reshaping the Property Market

Tokenized real estate introduces advantages that traditional property systems cannot match. One of the most significant is liquidity. Properties that historically took months to sell can now be traded within seconds on digital marketplaces. This shift turns illiquid assets into dynamic, tradable financial instruments.

Another benefit is fractional ownership. Investors no longer need significant capital to enter lucrative real estate markets. Even luxury properties or commercial buildings become accessible through micro-investments, enabling broader participation.

Transparency is also a key advantage. All transactions occur on blockchain networks, providing clear records of ownership and eliminating disputes. Smart contracts enforce terms fairly and automatically, reducing human error and manipulation.

Moreover, global accessibility significantly expands the investor base. Property developers and owners can raise capital from international investors, creating new business opportunities and boosting market competitiveness.

Challenges Slowing Down Rapid Adoption

Despite its massive potential, tokenized real estate is still in the early stages of adoption. Regulatory clarity is one of the biggest obstacles. Different countries have varied laws governing digital assets, securities, and property rights. Navigating these frameworks requires careful planning and legal expertise.

Another challenge is awareness. Many property owners and traditional investors are unfamiliar with blockchain technology, making it necessary to educate the market before widespread acceptance occurs. The lack of standardized global platforms also adds friction, as users often need guidance on selecting secure, compliant systems.

Cybersecurity is another concern. While blockchain itself is secure, platforms built on top of it must maintain robust security measures to protect user data, wallets, and tokenized assets.

Despite these challenges, the long-term growth trajectory remains promising. As more governments develop frameworks for digital asset regulation, adoption is expected to accelerate significantly.

Use Cases Propelling Tokenized Real Estate Forward

Tokenized real estate is not limited to residential or commercial properties alone. It spans multiple segments, including rental property, luxury real estate, hospitality, and land parcel tokenization.

Real estate developers are using tokenization to raise capital quickly and efficiently. Property management companies are exploring blockchain-based revenue-sharing models for distributing rental income. High-end residential properties are being tokenized to attract global investors seeking fractional ownership of premium assets.

Institutional players are experimenting with real estate-backed stablecoins and tokenized debt instruments. Governments are considering blockchain-based cadastral systems to secure land ownership records.

These developments highlight the scalability of tokenization across industries and asset types.

How Tokenization Is Changing the Future of Real Estate Markets

As tokenization becomes more mainstream, it introduces new business models and reshapes the way property investment, management, and financing operate. Tokenized marketplaces provide seamless trading environments that feel more like stock exchanges than traditional property portals. Funding rounds for property development become more accessible, transparent, and global.

For investors, tokenization adds liquidity, diversification, and flexibility. For developers, it opens a new channel of capital generation. For tenants and property managers, blockchain-enabled systems simplify operations, revenue distribution, and compliance.

Tokenization also aligns with the global push for digital transformation. Financial institutions, government bodies, and enterprises are increasingly exploring ways to integrate tokenized assets into their existing ecosystems.

Where the Market Is Heading Next

The next decade will likely witness the full integration of tokenized real estate with mainstream financial systems. Exchanges specializing in tokenized assets will become more regulated and globally recognized. Banking institutions may begin offering custody services for tokenized property shares.

As adoption rises, tokenized assets could become part of pension funds, insurance products, and mutual funds. Smart cities and digital governance frameworks will incorporate blockchain technology, creating an ecosystem where real estate tokenization plays a central role.

Institutional adoption will further cement tokenization as a legitimate and robust mechanism for property investment. As blockchain technology matures, the infrastructure supporting tokenized real estate will become more scalable, secure, and user-friendly.

Why Businesses Are Investing in Tokenization Infrastructure

Beyond investment benefits, businesses see tokenization as a way to improve operational efficiency and expand market reach. Property developers can tokenize their portfolios to attract global investors. Startups can launch tokenized funds to offer new financial products. Tech companies are entering the market with solutions for compliance automation, marketplace creation, and digital asset management.

This expanding ecosystem is creating opportunities for platform providers, investors, developers, and businesses worldwide. By implementing modern blockchain systems, companies can future-proof their operations and stay competitive in a rapidly evolving digital world.

The Strategic Role of Real Estate Tokenization Development

As the market progresses, more businesses recognize the importance of professional development services that build secure, compliant, and scalable tokenization platforms. This is where real estate tokenization development becomes essential, enabling enterprises to create customized platforms tailored to their property portfolios, investor base, and regulatory environment.

Developers focus on creating innovative contract architectures, compliance modules, KYC/AML systems, investor dashboards, and secure wallet integrations. They ensure that property rights, revenue distribution, and marketplace interactions run smoothly. In a competitive landscape, businesses relying on expert development services gain a significant advantage in launching successful tokenized real estate platforms.

Conclusion: A Future Built on Digital Ownership

Tokenized real estate is more than just a trend it is the next evolution of global property markets. As blockchain technology continues to advance and regulatory frameworks mature, tokenization will reshape the way people buy, sell, and invest in real estate.

The shift toward digital ownership is unlocking unprecedented liquidity, accessibility, and transparency. For investors, it offers new opportunities previously unimaginable. For businesses, it provides innovative ways to raise capital and expand their reach globally. For the real estate industry, it marks the beginning of a new era in which borders fade, barriers fall, and ownership becomes truly democratized.

Leave a Reply

Want to join the discussion?Feel free to contribute!