How to Download EPF Form 2 for Multiple Provident Fund Accounts

Employee Provident Fund (EPF) is a vital savings scheme for salaried individuals in India, and Form 2 is a critical document within the EPF framework. EPF Form 2 is used to nominate family members who can claim the benefits of provident fund accumulations and Employees’ Deposit Linked Insurance (EDLI) in the unfortunate event of the member’s death. When managing multiple provident fund accounts, downloading and submitting EPF Form 2 correctly across accounts is essential. This article provides a step-by-step guide on downloading EPF Form 2 for multiple accounts and details the process.

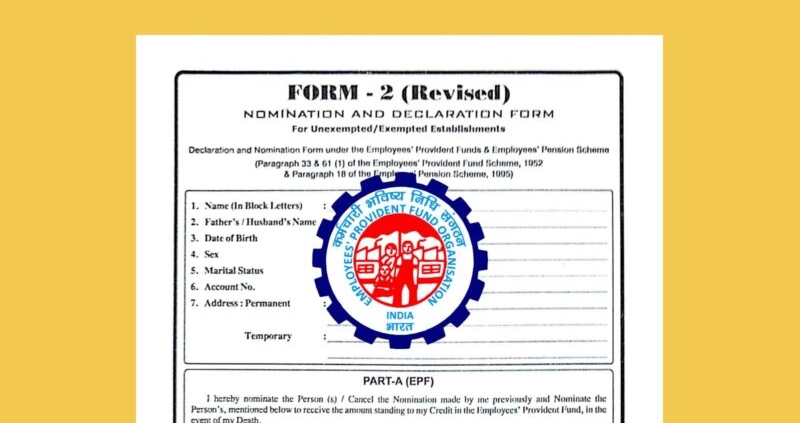

Understanding EPF Form 2

EPF Form 2 is used to nominate dependents such as your spouse, children, or parents. The document is compulsory for all EPF account holders and ensures a seamless claim process for nominees in case of the account holder’s untimely passing. Those with multiple EPF accounts must ensure that nominations are correctly updated for each account to maintain uniform records across their PF portfolio.

As an employee, you can access EPF Form 2 via the official EPFO website. There are no charges associated with downloading this form, which is easily available online. For those managing accounts actively, coordinating nominations under EPF Form 2 is crucial to secure your family’s financial future.

Step-by-Step Guide to Download EPF Form 2

If you have multiple EPF accounts, downloading EPF Form 2 for each is a straightforward process. Follow the instructions below:

Step 1: Log in to the Official EPFO Website

Visit the Employee Provident Fund Organization (EPFO) website. Navigate to the member portal section, where account holders can manage account-related activities.

Step 2: Access Form Downloads

Under the “Forms” section, look for EPF-related forms. EPF Form 2 is listed among these downloadable resources. Select Form 2 and download a PDF version to your device.

Step 3: Create Multiple Nomination Forms

If you hold multiple EPF accounts with different organizations, you must download and furnish EPF Form 2 independently for each account. Ensure that you enter account-specific details correctly on each version of the form.

Step 4: Submit the Forms via Employer or Online Portal

Completed EPF Form 2 must be submitted to your employer for processing. Alternatively, some organizations may allow online submission of the form through their internal portals linked to EPFO.

Step 5: Keep Acknowledgment Copies

Once your EPF Form 2 submissions are processed for all accounts, ensure you retain acknowledgment copies for personal records. These copies serve as proof of nomination modifications.

Link Between EPF and Other Schemes Like NPS

The National Pension System (NPS), akin to EPF, is another vital retirement savings scheme in India. While EPF focuses on salaried employees, NPS provides investment opportunities to a broader demographic, including self-employed individuals. It is not uncommon for employees to overlap investments in both EPF and NPS accounts simultaneously to diversify their savings portfolio.

Here’s an illustrative calculation comparing EPF and NPS contributions:

Comparison Example:

– Assume a monthly EPF contribution of ₹10,000 (employee and employer combined).

– Over 20 years with an 8% compounded annual return, the EPF corpus would grow to approximately ₹59,00,000.

In contrast:

– A monthly NPS contribution of ₹10,000 with a 10% annual return would fetch around ₹76,50,000 over the same period.

Such calculations highlight the potential of each scheme, though personalized strategies depend on risk appetite and investment goals.

For individuals managing both schemes, proper financial planning is necessary. However, nominations in EPF and NPS accounts do not automatically overlap. EPF Form 2 nominations solely apply to EPF accounts and must be furnished separately.

Precautions While Managing Form 2 for Multiple EPF Accounts

1. Check Employer Policies: Some organizations may facilitate combined forms for centralized processing. However, this depends entirely on their internal systems.

2. Verify Fields: Enter nominee details carefully to avoid discrepancies.

3. Link UAN Across Accounts: Unified Account Number (UAN) serves as a bridge between multiple EPF accounts. Ensure your UAN is updated for better synchronization of profile and nominations.

4. Conflict in Nominee Claims: If updates are inconsistent between accounts, complications may arise during claims. Keeping consistent records across all EPF accounts is strongly suggested.

Summary

EPF Form 2 is instrumental in securing family benefits under EPF and EDLI schemes, especially for individuals managing multiple provident fund accounts. The document nominates beneficiaries and assures a smooth transfer of funds under unfortunate circumstances.

1. Log in to the EPFO portal.

2. Access member forms and identify EPF Form 2.

3. Download the form for each PF account independently.

4. Submit completed Form 2 through your employer or online platform.

When dealing with multiple accounts, ensure uniformity in nomination details across accounts. Schemes like NPS add further layers to personal finance management but require managing separate nomination records. From an illustrative perspective, investing ₹10,000 monthly into EPF and NPS could yield corpus values of ₹59,00,000 and ₹76,50,000 over 20 years at 8% and 10% annual returns respectively. Such comparisons demand a clear understanding of individual scheme dynamics.

Disclaimer:

The information provided herein is for educational purposes only and does not constitute financial advice. Investors are advised to carefully analyze the pros and cons of investments in the Indian financial market and consult with a financial advisor if required. EPF and NPS calculations are purely illustrative and can vary significantly based on terms and market conditions.

Leave a Reply

Want to join the discussion?Feel free to contribute!