Chapes-JPL: Secure Collateral Loans for Fast Access to Cash

In today’s fast-paced world, financial emergencies can appear without warning. From sudden medical bills to urgent home repairs or business opportunities that require immediate capital, having quick access to funds is often a necessity. Unfortunately, traditional bank loans usually involve lengthy applications, strict credit requirements, and weeks of waiting for approval.

This is where Chapes-JPL has been making a difference for more than 40 years. As a trusted provider of collateral loans, Chapes-JPL allows individuals to unlock the value of their gold, diamonds, silver, luxury watches, fine art, and other valuables in exchange for fast cash. To learn more about how their services can benefit you, visit Loans for Silver in Alpharetta and see how simple and stress-free the borrowing process can be.

How Collateral Loans Work

Collateral loans operate on a straightforward principle: instead of relying on your credit score, income verification, or borrowing history, the loan amount is based on the appraised value of your valuables.

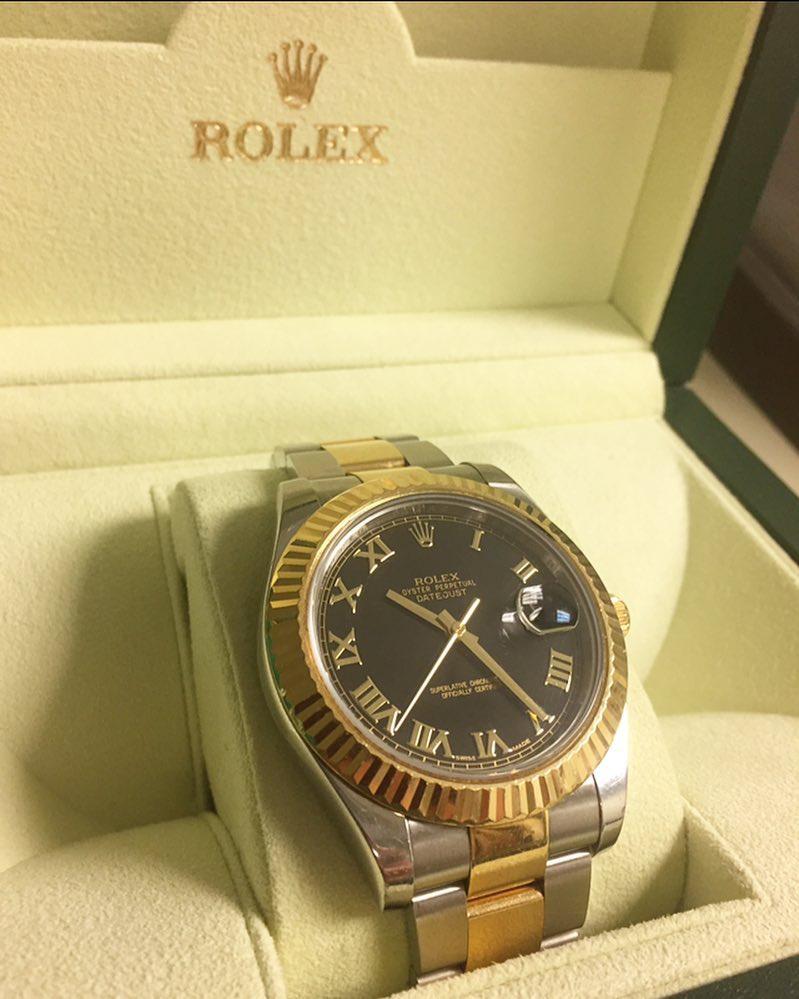

For example, if you own diamond jewelry, a Rolex watch, or silver bullion, Chapes-JPL’s professional appraisers will carefully assess your item’s market value. Once the appraisal is complete, you are offered a loan amount. If you agree, the funds are provided almost immediately, often within the same day.

This process eliminates the need for credit checks and paperwork. Whether you have excellent credit, poor credit, or no credit history at all, you can still access the funds you need quickly and securely.

Why Choose Chapes-JPL?

Over the years, Chapes-JPL has earned a reputation as one of the most trusted and professional collateral loan providers in the Atlanta area. Their approach sets them apart from pawn shops and traditional lenders in several important ways:

- Low Interest Rates: Chapes-JPL offers loans starting at just 3%, which is significantly lower than the rates charged by payday lenders and credit cards.

- Fast Approvals: Most loans are processed in minutes, giving you immediate access to the funds you need.

- Private and Secure Transactions: All loans are handled in upscale, discreet offices rather than at a public pawn counter, ensuring your comfort and privacy.

- Experience and Expertise: With more than four decades in the industry, Chapes-JPL has helped thousands of clients with fair, professional, and transparent lending services.

These benefits make Chapes-JPL an excellent choice for anyone seeking quick and reliable access to cash.

What Items Can Be Used as Collateral?

One of the biggest advantages of borrowing through Chapes-JPL is the flexibility of items accepted as collateral. You don’t need to limit yourself to one type of asset. Some of the most common items accepted include:

- Gold and diamond jewelry: Engagement rings, necklaces, bracelets, and more.

- Luxury watches: Rolex, Omega, Cartier, and other high-end brands.

- Silver bars and coins: From bullion to collectible silver pieces.

- Fine art and antiques: Paintings, sculptures, and rare collectibles of significant value.

This wide acceptance means that many people can leverage items they already own to secure a loan rather than selling them outright. Once the loan is repaid, the items are returned in their original condition.

Secure Storage for Your Valuables

Security is a top priority when you pledge valuable assets. Chapes-JPL ensures that all items are kept in a state-of-the-art, fully insured storage facility. This means your valuables remain safe and well-protected throughout the loan period.

When your loan is repaid, your items are returned promptly and securely, giving you complete peace of mind. This level of care and professionalism is one of the reasons clients trust Chapes-JPL with their most prized possessions.

Collateral Loans vs. Traditional Bank Loans

Borrowers often wonder whether collateral loans are a better option compared to traditional bank loans. While both methods provide access to funds, collateral loans are faster, simpler, and more flexible.

- Approval Time: Banks can take weeks to approve a loan, whereas collateral loans are usually processed within minutes.

- Credit Requirements: Banks require strong credit histories. Chapes-JPL collateral loans require no credit checks at all.

- Accessibility: Many people who cannot qualify for bank loans can still secure funds through collateral lending.

For those who need fast, stress-free access to cash, collateral loans provide a clear advantage.

Who Benefits from Collateral Loans?

Collateral loans are designed to help a wide range of clients, including:

- Entrepreneurs: Business owners who need quick capital for operations or growth opportunities.

- Families: Households dealing with emergencies such as unexpected medical bills or home repairs.

- Collectors and investors: People who own luxury items but don’t want to sell them permanently.

Because the process is quick, private, and affordable, collateral loans are an excellent solution for anyone needing immediate financial assistance.

Start Your Financial Journey with Chapes-JPL

When financial challenges arise, it’s important to have a trusted partner you can count on. With fast approvals, low-interest rates, secure storage, and over 40 years of experience, Chapes-JPL has become the leading name in collateral lending in the Atlanta area.

Instead of waiting weeks for a bank or risking high interest rates with payday lenders, you can unlock the value of your gold, silver, diamonds, or other valuables today. To take the first step, visit Loans for Silver in Alpharetta and learn more about how Chapes-JPL makes borrowing fast, secure, and worry-free.

Leave a Reply

Want to join the discussion?Feel free to contribute!