QuickBooks W-2 & W-3 Forms: Easy Step-by-Step Guide

Printing your W-2 and W-3 forms in QuickBooks can feel overwhelming, especially during the busy tax season. QuickBooks W-2 printing and W-3 form instructions are designed to make this process seamless for business owners, payroll managers, and accountants alike. By learning how to print W-2 in QuickBooks and generate the W-3 summary form, you can ensure accurate reporting, timely IRS filing, and smooth end-of-year payroll management. For expert help with QuickBooks payroll forms or W-2 filing, you can call +1(866)500-0076 to get direct assistance.

QuickBooks payroll forms, such as W-2s and W-3s, are essential for reporting employee earnings and taxes. The W-2 form reports wages, tips, and other compensation, while the W-3 form acts as a summary of all W-2s submitted to the IRS. Understanding how to print employee W-2s in QuickBooks or file the W-3 summary can save time, prevent errors, and keep your business compliant with federal and state tax requirements.

QuickBooks makes printing W-2 and W-3 forms easy—follow our complete guide for seamless payroll tax filing.

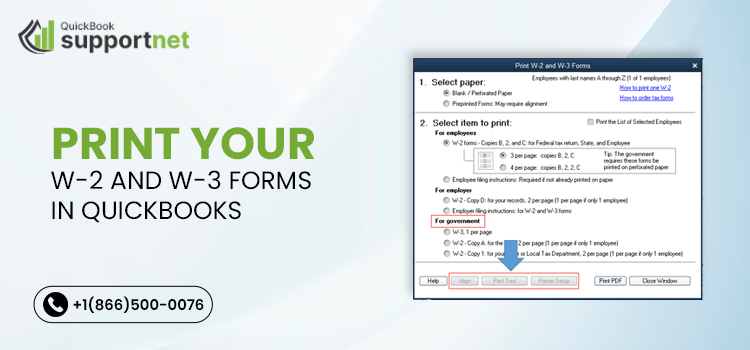

Step-by-Step Guide to Printing W-2 Forms in QuickBooks

- Open QuickBooks Payroll:

Launch QuickBooks and go to the Employees menu. Choose Payroll Center to access your payroll features. - Select Employees and Forms:

Click File Forms, then select Annual Form W-2/W-3 – Wage and Tax Statement/Transmittal. - Verify Employee Information:

Ensure each employee’s information, including Social Security numbers, addresses, and wage data, is accurate. Correct any discrepancies before printing to avoid IRS issues. - Print W-2 Forms:

Click Print/E-file and choose Print W-2s. QuickBooks allows printing on pre-printed W-2 forms or blank paper. - Review and Confirm:

After printing, review the forms to ensure all information is correct. Once confirmed, distribute W-2 forms to employees by January 31st.

How to Print the W-3 Form in QuickBooks

The W-3 form summarizes all W-2 forms submitted for your employees and must be filed with the IRS. Follow these steps to generate your W-3 in QuickBooks:

- Go to the Payroll Center and select File Forms.

- Choose W-2/W-3 Forms from the dropdown menu.

- QuickBooks will automatically compile the W-3 summary based on the W-2 data.

- Print the W-3 form and file it alongside your W-2 forms with the IRS.

Remember, accurate W-3 submission ensures your W-2 forms are correctly processed by the IRS and helps prevent penalties.

Tips for Smooth QuickBooks W-2 and W-3 Printing

- Verify Payroll Data: Double-check wages, tax withholdings, and employee addresses.

- Update QuickBooks: Ensure your software is updated for the latest tax year forms.

- Use Pre-Printed Forms: If filing paper W-2s, use IRS-approved pre-printed forms.

- Consider E-Filing: QuickBooks electronic W-2 filing can save time and reduce errors.

By following these best practices, generating W-2 forms and filing the W-3 summary in QuickBooks becomes a stress-free process.

Common Issues and How to Fix Them

- Incorrect Employee Details: Correct errors in the Employee Center before printing forms.

- Form Alignment Issues: Use the Print Setup feature to adjust margins and ensure W-2s print correctly.

- Missing Payroll Data: Run payroll reports to verify all wages and tax deductions are included.

For immediate help resolving any QuickBooks W-2 printing or W-3 filing issues, call +1(866)500-0076. QuickBooks experts can guide you through troubleshooting and ensure accurate filing.

Conclusion

Printing your W-2 and W-3 forms in QuickBooks doesn’t have to be complicated. By following a clear process, verifying employee and payroll information, and using QuickBooks payroll forms efficiently, you can file IRS forms accurately and on time. Remember to review your forms carefully, consider electronic filing for convenience, and reach out to QuickBooks support if needed. Properly managing end-of-year payroll reporting protects your business from fines and keeps employees happy with timely tax documents

FAQs

Q1: Can I print W-2s and W-3s for multiple employees at once in QuickBooks?

Yes, QuickBooks allows batch printing of W-2 forms and automatically generates the W-3 summary for all employees.

Q2: What if I find an error after printing W-2s?

You can correct the employee information in QuickBooks and reprint the W-2. Make sure to submit corrected W-2s (Form W-2c) if the original has been filed with the IRS.

Q3: Can I e-file W-2 and W-3 forms directly from QuickBooks?

Yes, QuickBooks offers electronic W-2 and W-3 filing, which is faster, reduces errors, and meets IRS requirements.

Q4: Is there a deadline for distributing W-2 forms?

W-2 forms must be distributed to employees by January 31st of the following year. W-3 forms are filed with the IRS along with W-2 submissions.

Q5: How can I get help printing W-2 and W-3 forms in QuickBooks?

You can call +1(866)500-0076 for expert guidance on QuickBooks payroll forms, troubleshooting, and filing assistance.

Read Also: QuickBooks Form 941

Leave a Reply

Want to join the discussion?Feel free to contribute!